MOOWR Scheme: An Untapped Opportunity for Indian Manufacturers and Exporters

-By CA Dhruv M Parekh

(Indirect Tax Expert)

The Indian government has consistently worked to boost manufacturing and exports by offering a range of fiscal and procedural incentives. Among these, the Manufacture and Other Operations in Warehouse Regulations, 2019 (MOOWR) scheme stands out as a simplified and efficient tool for capital and operational savings. Yet, it remains one of the most underutilized schemes due to lack of awareness. This article aims to demystify MOOWR, its eligibility, benefits, and compliance framework.

- What is MOOWR?

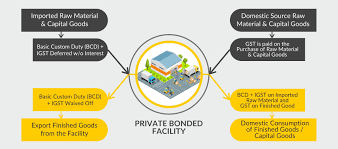

- MOOWR, introduced by the Central Board of Indirect Taxes and Customs (CBIC), enables businesses to carry out manufacturing and other operations in a customs bonded warehouse without payment of import duties (Basic Customs Duty and IGST) at the time of import. Duties are payable only when the goods are cleared up for domestic consumption. If goods are exported, no duties are payable at all.

- Effectively, it allows deferment of duty and complete exemption for export-linked imports, improving cash flow and competitiveness.

- Who Can Apply for MOOWR?

The scheme is open to:

- Manufacturers (including contract manufacturers)

- Exporters of goods and services

- Traders engaged in re-export or high-value add assembly

- Warehousing units importing capital goods or raw materials

There is no export obligation or minimum investment threshold—unlike schemes such as SEZ (Special Economic Zone) or EOU (Export Oriented Unit). Even domestic suppliers can be involved in the manufacturing process inside the bonded facility.

- Key Benefits of MOOWR

Deferred Customs Duty: Import duties on capital goods and raw materials are deferred until the goods are cleared for home consumption.

Duty Exemption on Exports: No customs duty on inputs/capital goods used for exported goods.

No Export Obligation: The scheme is non-restrictive in terms of minimum export performance.

No Time Limit on Warehousing: Capital goods can be warehoused indefinitely without duty payment.

Cash Flow Optimization: Improved working capital management due to delayed duty outflow.

Why Did the Board Introduce MOOWR?

CBIC’s intention was to:

- Boost ‘Make in India’ by enabling easy access to imported capital goods.

- Enhance ease of doing business by simplifying regulatory compliance.

- Encourage small and mid-sized manufacturers to grow without stringent export requirements.

- Offer a level playing field with global players who benefit from similar schemes abroad.

- By allowing duty deferment and minimal paperwork, the MOOWR scheme is also aligned with India’s goal of increasing its share in global supply chains.

- Compliances Under MOOWR

While the scheme is business-friendly, certain regulatory compliances must be maintained:

- Licensing: Filing an application (Form MW-1) with the jurisdictional Principal Commissioner/Commissioner of Customs.

- Bond Execution: Submission of a triple duty bond (Form MW-2) for safeguarding deferred duty.

- Record Maintenance: Proper inventory and operational records must be maintained and made available for audit.

- Monthly Returns: Filing of monthly return (Form MW-3) covering inflow, manufacturing, and clearance details.

- Customs Permission: Prior permission required for the removal of goods from bonded premises.

Conclusion

MOOWR offers a strategic advantage to manufacturers and exporters looking to optimize cost and cash flow. Its flexibility, absence of export obligation, and ease of entry make it ideal for MSMEs as well as large industrial units. However, awareness and proactive consultation with professionals are key to unlocking its full potential.

As professionals, it is imperative we help clients explore MOOWR as a viable alternative to more complex export incentive schemes.