GST WEEKLY UPDATE : 7/2023-24 (14.05.2023) By CA Vipul Khandhar

-By CA Vipul Khandhar

- Automated Return Scrutiny Module for GST returns in ACES-GST:

- CBIC has rolled out the Automated Return Scrutiny Module for GST returns in the ACES-GST backend application for Central Tax Officers this week. This module will enable the officers to carry out scrutiny of GST returns of Centre Administered Taxpayers selected on the basis of data analytics and risks identified by the System.

- In the module, discrepancies on account of risks associated with a return are displayed to the tax officers. Tax officers are provided with a workflow for interacting with the taxpayers through the GSTN Common Portal for communication of discrepancies noticed under FORM ASMT-10, receipt of taxpayer’s reply in FORM ASMT-11 and subsequent action in form of either issuance of an order of acceptance of reply in FORM ASMT-12 or issuance of show cause notice or initiation of audit / investigation.

- Implementation of this Automated Return Scrutiny Module has commenced with the scrutiny of GST returns for FY 2019-20, and the requisite data for the purpose has already been made available on the officers’ dashboard.

- E-invoice threshold limit has been reduced to Rs.5 cr from Rs.10 crore w.e.f. 01.08.2023:

- The government has also lowered the threshold for businesses to generate e-invoice for business-to-business (B2B) transactions to Rs 5 crore from Rs 10 crore under GST. The changes will come into effect from August 1.

- In a notification dated May 10, the Finance Ministry has announced lowering of the threshold for e-invoicing. At present, businesses with turnover of Rs 10 crore and above are required to generate e-invoice for all B2B transactions.

- E-invoicing for B2B transactions was made mandatory for businesses with turnover of over Rs.500 crore from October 1, 2020. Then it was extended to businesses with turnover of over Rs .100 crore from January 1, 2021, after which it was extended to businesses with turnover of over Rs.50 crore from April 1, 2021, and then the threshold was lowered to Rs.20 crore from April 1, 2022. It was further reduced to Rs.10 crore from October 1, 2022.

- GTA FCM opt in option for FY 2023-24 extended till 31/05/23:

GSTN enabled Option to file declaration in Annexure-V to opt for payment under FCM by GTA. Functionality can be accessed at: Dashboard > Services > User Services > Opting Forward Charge payment by GTA (Annexure V) > Select FY & apply

- New functionality started at GST portal:

Extension time for filing application for revocation of Suo Moto cancellation of registration.

As announced by the Government, availment of amnesty scheme, between 1st April 2023 and 30th June 2023, has been enabled for taxpayers on the portal. Now taxpayers cancelled Suo moto between 1stJuly, 2017 and 31st December, 2022, would be able to file application for revocation of cancellation of registration, irrespective of the fact whether they have already filed revocation application or not.

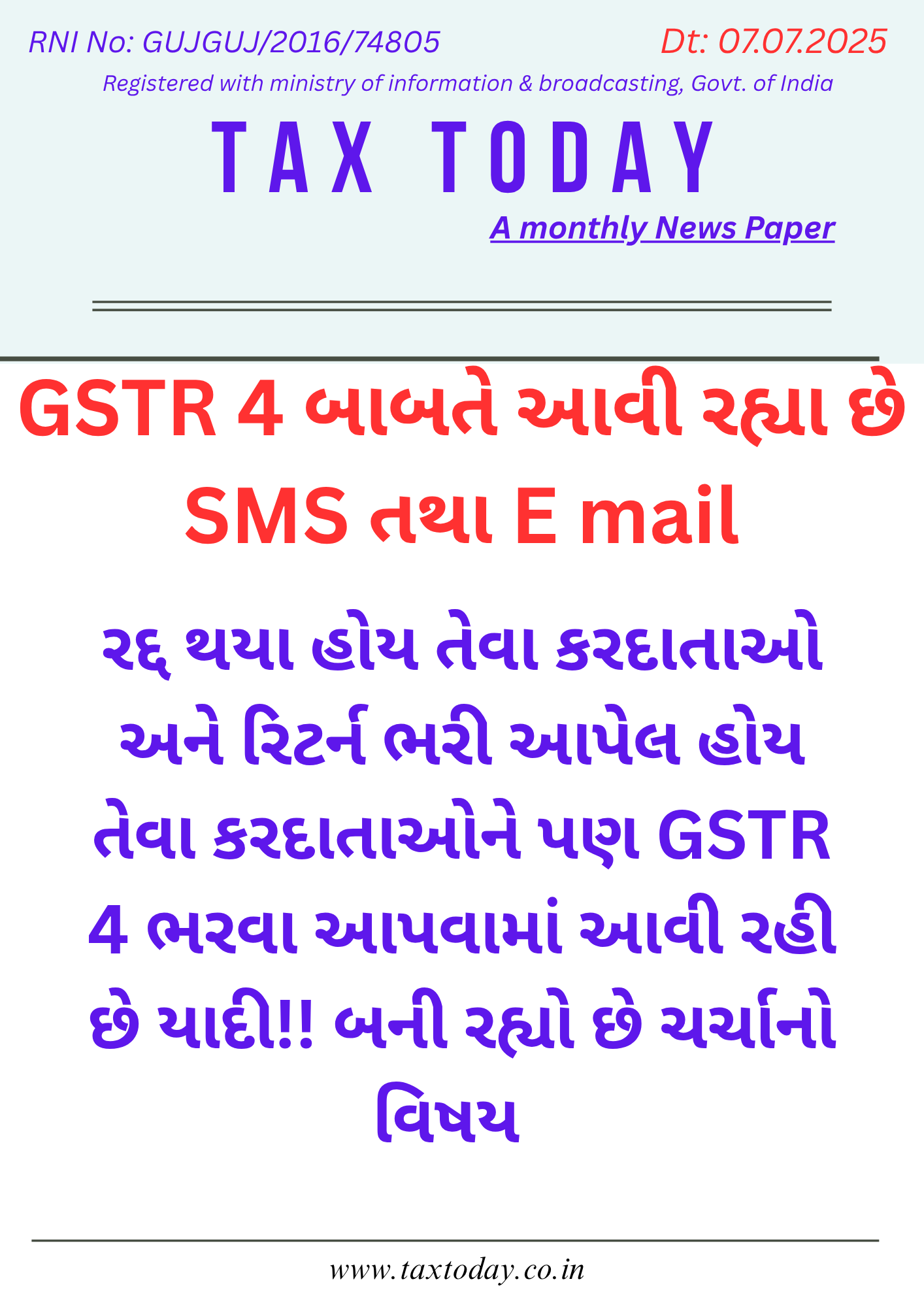

Relaxation in late fees of annual return:

| Sr. No. | Form | Capping on late fee payable per tax period (Rs.) | Amnesty Period | Applicable Tax Period |

| 1 | GSTR-4 (Quarterly) | 500.00 | Filed between 1st April, 2023 and 30th June, 2023 | 2017-18 & 2019-20 |

| 2 | GSTR-4 (Annual) | 500.00 | 2019-20 to 2021-22 | |

| 3 | GSTR-10 (Final Return) | 1000.00 | 2017-18 to 2021-22 | |

| 4 | GSTR-9 (Annual Return) | 20000.00 | 2017-18 to 2021-22 |

Change in due date of filing GSTR-5

Section 39 was amended vide Finance Act, 2022 (6 of 2022) and the changes in due date for filing of Form GSTR-5 were notified on 30th March, 2022.

Accordingly, the due date for filing Form GSTR-5 has been changed and implemented on the portal as under:

| Sr. No. | Tax Period | Due Date |

| 1 | Upto September, 2022 | 20th of succeeding month (No change) |

| 2 | From October, 2022 onwards | 13th of succeeding month |

The amendments in the GST Act were implemented w.e.f. 1stOctober, 2022.

New option to authenticate filing of Form GST CMP-08 using STAK.

In addition to the existing modes of authentication towards filing on the portal i.e. DSC and EVC, a new mode of authentication for filing of Form GST CMP-08 using Single Use Time-Based Authentication Key (STAK) has been implemented on the portal. The taxpayers need to install “GST Secure OTP” app on their android device. This enables the taxpayers, other than companies and LLP, to generate a token on their mobile and use the same while filing Form GST CMP – 08 on the GST web portal.

Amnesty for non-filers assessed under section 62 i.e. Withdrawal of ASMT 13 Order on Filing of Return within Amnesty Scheme

If a return in Form GSTR-3B is filed after expiry of 30 days from date of order creating demand u/s 62, then such demand is not nullified automatically.

The Government has provided a relief to such taxpayers i.e. those who have not filed their returns in form GSTR 3B within 30 days from the date of creation of demand, provided they file form GSTR 3B and extinguish their pending tax liabilities by 30th June, 2023 even though the period of 30 days has expired. The demand created against non-filers would be nullified.

- AAR & Judicial Decisions:

(i) CAAR On Classification of Chromecast with Google TV:

(Applicant – Rashi Peripherals Limited)

On examining the functions of ‘Google Chromecast’ and ‘Chromecast with Google TV’ as stated in the aforesaid paras vis-a vis the material information available in the public domain, CAAR find that ‘Google Chromecast’ is a streaming device that enables casting videos, slideshows, music, or even screen mirror by wirelessly connecting the phone, tablet, or computer with an HD monitor that has an HDMI port and ‘Chromecast with Google TV’ is capable of casting content in exactly the same way by using the smartphone, tablet, laptop, etc., along with having its own dedicated interface and built-in selection of apps. Thus the main difference between Google Chromecast and Chromecast with Google TV is that Google Chromecast doesn’t have any apps, it just casts content, whereas Chromecast with Google TV is capable of casting and has an integrated interface with on-screen apps and remote. “Chromecast with Google TV” derives its functions from both the sources i.e. from the third equipment like smart phone or laptop and also directly functioning by using the device’s onscreen interface without using a third equipment in between. CAAR find that the subject goods are capable of performing both these functions and are only a mere improvement over the earlier model “Google Chromecast”, that is under legal dispute. I find that in the instant case the principal or primary function of `Chromecast with Google TV’ is not distinctly different from the functionality of `Google Chromecast’. Hence on this basis `Chromecast with Google TV’ device cannot be treated as an apparatus that is entirely different from `Google Chromecast’ the classification of which is under legal dispute over classification under Customs Tariff Act, 1975.

By virtue of the foregoing discussion CAAR find that “Chromecast with Google TV” cannot be treated as an altogether generically different product qualifying for a different classification under Customs Tariff Act, 1975. Hence CAAR hold that, against the claim of the applicant, as declared at Sr. No. 11 of the CAAR-1 application, the matter of classification of their own similar device is pending decision before honourable Tribunal, CESTAT. Accordingly, in view of provisions of Section 28-I of the Customs Act, 1962, CAAR refrain from passing an order till the matter in dispute has been settled.

Disclaimer:

This publication contains information for general guidance only. It is not intended to address the circumstances of any particular individual or entity. Although the best of endeavour has been made to provide the provisions in a simpler and accurate form, there is no substitute to detailed research with regard to the specific situation of a particular individual or entity. We do not accept any responsibility for loss incurred by any person for acting or refraining to act as a result of any matter in this publication.

(Author is a well known Chartered Accountant Practicing at Ahmedabad)